Crypto Asset Segregation and the Need for Crypto Asset Management

- Crypto assets rose to prominence in the last few years.

- This has led to a rise in crypto-asset segregation and crypto-asset management.

Crypto assets, also called cryptocurrencies, have been in vogue for the last few years as a unique form of currency. They are being preferred by investors across the globe. They are giving it more importance than stocks and other forms of investments.

There are seven major types of crypto assets available in the market, namely:

- Bitcoins

- Altcoins

- Privacy Coins

- Non-Fungible Tokens (NFTs)

- Stablecoins

- Security Tokens

- Utility tokens

- Privacy Coins

What is Crypto-Asset Segregation?

It refers to the process of separating an investor’s assets from the assets of the exchange of custodians where they are held. This separation ensures that an investor’s assets are protected from any financial difficulties the exchange of custodians may face. In other words, if the exchange or custodian were to go bankrupt, the investor’s assets would be left vulnerable.

The most secure way of segregating crypto assets is by maintaining three different accounts for different occasions namely: a mint account, a selling account, and a vault account.

- Mint Account – You should maintain the least possible value in this account like 0.1 ETH. This account should be used for accessing untrustworthy or malicious platforms. It is best for NFTs or trying out new platforms.

- Sell Account – This account should specifically be used for trading i.e., selling and buying of crypto assets. However, you must not keep bulk values in it either. Only transfer the amount/asset that you need, here.

- Vault Account – As the name suggests, in this account you should keep all your digital assets. In any situation, you should never sign any transactions of any kind from here. This account should be kept away from all kinds of threats. The only kind of signatures it requires should be “Gasless Signatures” which is considered more as an identity checker.

Why is Crypto Asset Management Essential?

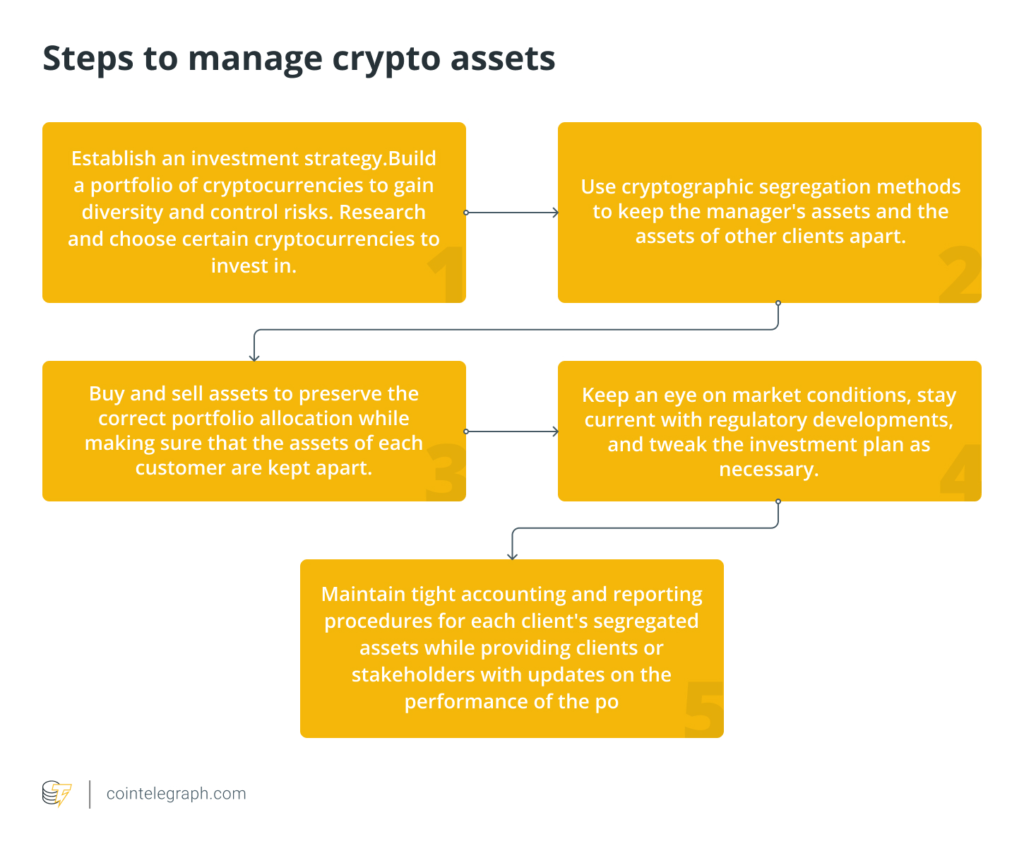

Crypto asset management refers to the process of supervising and improving investments in cryptocurrency assets. This involves the use of various techniques to maximize profits and minimize risks.

Crypto asset management presents several benefits for investors and organizations holding cryptographic assets. Organizations and various trading platforms like Binance, that manage cryptocurrency assets, provide managerial services which offer risk analysis, portfolio rebalancing, and guidance for future investments. These services are for people who lack knowledge of this market.

Conclusion

Crypto asset segregation is an important aspect of crypto asset management. It ensures that an investor’s assets are protected from financial problems faced by exchanges or protections. The use of private keys, multiple accounts, and other security measures are all crucial components of crypto asset segregation. As the popularity of crypto assets continues to grow, it is important for investors to understand how crypto asset segregation works and to choose exchanges and protections that prioritize the security of their client’s assets.